Calculate Intrinsic Value of Stock Online

It refers to what a stock or any asset for that matter is actually worth -- even if some investors think its worth a lot more or less than. So Dawkins needs to mask that by using anti-Bible Prolifers who like him also claim human is biological so shriek abortion is murder.

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Theres more than one way to determine the value of an investment.

. The intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business in terms of both. An analyst placing a value on a company looks at the company. Typically when calculating a stocks intrinsic value investors can determine an appropriate margin of safety wherein the market price is below the estimated intrinsic value.

Markets for instance let you know what investors are willing to pay right now for shares of stock or a companys bonds. So Dawkins thinks he smears God and masks Bibles SOUL definition of man Gen 27 all the while reaming out the anti-Bible Prolifers as enemies to science. There are many techniques used to determine value.

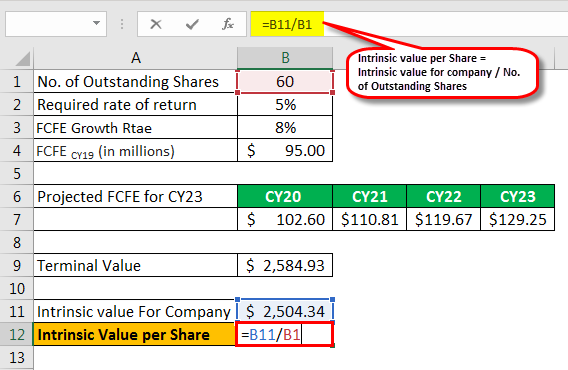

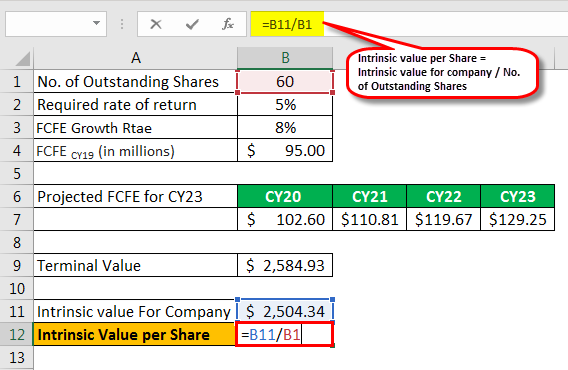

This gives you the fair value price you should pay for a stock. The Easy Way to Calculate Beta. The premise of the DCF approach states that an asset the company is worth the sum of all of its future free cash flows FCFs which are discounted to the present day to account for the time value of money ie 1 received today is worth more than 1 received on a later date.

The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 19. In Table 3 it has an intrinsic value of 180 ie the strike price of 29 less the stock price of 2720 and the time value of 039 ie the put price of 219 less the intrinsic value of. Active investors calculate a series of metrics to estimate a stocks intrinsic value and then compare that value to the stocks current market price.

The intrinsic value of a stock is its true value. Let me also share formula to calculate the intrinsic value of the stock which is based on Benjamin Grahams original formula to calculate the intrinsic value. In cell B2 enter B4B6-B5 The current intrinsic value of the stock ABC in this example is 398 per share.

Intrinsic Value. Since it is not feasible to project a companys FCF indefinitely the. Similarly in case of equity shares the value of the net assets or the present value of the future cash flows can be interpreted as the intrinsic value of the stock.

A particular method to calculate and to determine this value consists of two steps. The idea is that it is best to invest in companies that have a higher true. Fundamental analysis is a method of evaluating a security in an attempt to measure its intrinsic value by examining related economic financial and other qualitative and quantitative factors.

Stock Rover has the following Beta Calculation. This intrinsic value is the embedded value in the asset irrespective of market expectations and government fiat. As market value contains a number of other factors in calculation of assets value intrinsic value tells us the pure value of a stock.

Unlike relative forms of valuation that look at comparable companies intrinsic valuation looks only at the inherent value of a business on its own. Beta 1-Year Beta 3-Year. The intrinsic value of a stock forms the basis for buy and sell recommendations in the stock market.

Valuation is the process of determining the current worth of an asset or a company. Using a stock screener with powerful financial analysis is the easiest way to calculate complex financial ratios like Beta. Intrinsic value is a core metric used by fundamental analysis-based investors to analyze a company.

Type in the current AAA corporate bond yieldThe current AAA corporate bond yields in the United States are about 422. Input the expected annual growth rate of the company. To calculate the intrinsic value of a stock you estimate a companys future cash flow discount it by the compounded inflationinterest rate and divide the result by the number of shares outstanding.

After placing the above values in the DCF Calculator the true intrinsic value per share of ITC turns out to be Rs 21480 after a margin of safety of 20 on the final intrinsic price. This is the intrinsic value estimate per share for Indian Tobacco Company at the time of writing using the DCF model Dec 2021. The rate of return earned on the original amount of capital invested or the present value PV.

I will not say that the intrinsic value estimated by this formula is absolutely perfect. Finally you can now find the value of the intrinsic price of the stock. Let us see how to calculate the intrinsic value of a stock using our online intrinsic value calculator.

Enter the current market. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 19. So with the help of this value an investor can get the information about how rationally his stocks are priced.

We own and operate 500 peer-reviewed clinical medical life sciences engineering and management journals and hosts 3000 scholarly conferences per year in the fields of clinical medical pharmaceutical life sciences business engineering and technology. Enter the earnings per share of the company. We are an Open Access publisher and international conference Organizer.

But what is intrinsic value of option. But for newbie investors it will give a fair idea about the true value of stocks. For investors and corporations alike the future value FV is calculated to estimate the value of an investment on a later date to guide decision-making.

The calculated future value FV is a function of the interest rate assumption ie. Terminal Value TV Definition. The intrinsic value is often a form of fundamental analysis and will vary from the market value.

Using this adjusted EPS value we can. The intrinsic value of a business or any investment security is the present value of all expected future cash flows discounted at the appropriate discount rate. End Chapter Eight no more value here.

Stock Rover our review-winning stock research and analysis screener makes calculating Beta easy.

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Comments

Post a Comment